Table of Content

For example, when an accident occurred, your tires may have been 60 per cent worn. Because the life of the tires has been extended, a 60 per cent betterment charge would apply. In the interim, you should take reasonable steps to protect your property from further damage, e.g., move furniture/contents to another area. As long as your request is submitted in writing, we are obligated to provide this information within 30 days or otherwise stated.

Below we have listed the exclusions found in the contract for the basic Co-operators home insurance package. For example, if you care about the environment or making your home more efficient you might be interested in the Enviroguard coverage. If you live in New Brunswick you might be interested in Above-ground Water coverage. There’s a £15 fee for missing a direct debit payment. If you do not want to renew your policy, and your policy is not set to automatically renew, you don’t need to do anything further. You need to arrange specific cover for high risk items or personal belongings worth over £3,000.

The worst experience with this insurance

InsurEye is not owned by any bank, insurance company, insurance brokerage or any other financial services institution. We collect, validate, and analyze insurance experiences of real consumers. They just pulled my insurance because I’ve started a small home business. 29+ years with them, not a single claim and I get terminated.

To ensure your family's safety, we will send a contractor to secure your residence. You can then provide us with a complete inventory of the missing items, including a description. Look for any photos, receipts, appraisals, guarantees or warranties. It is worth remembering that during and directly after severe weather events Co-operators' phone lines will be busy than normal and that claims processing may take longer than usual.

With industry specialties include admiral insurance answered all cooperators insurance cancellation policy

Permanent life insurance has no expiry date and the premiums don’t change over the life of the policy. Permanent life also includes an investment component through universal and whole life coverage. The Co-operators uses credit score, where permitted by provincial regulations, as a rating factor to determine home insurance premiums. The value of using credit score has been demonstrated as a useful and accurate predictor for future home insurance claims. In fact, most major property insurers in Canada have been using credit score for years. Credit score is used with other more traditional rating factors such as claims history, age of home and geographical location to determine the level of risk and appropriate premium.

Critical illness is another insurance tool that can help sustain you ― and your family ― in case of a debilitating illness that leaves you unable to work. Find out if you have the right balance of life insurance and investments. Insurance rates, or premiums, are based on risk, or the potential that someone will make a claim. The greater the risk, the higher the premium; the lower the risk, the lower the premium. To set rates, we study the claims history of groups of people with similar characteristics and then add information about your particular history to determine the exact premium.

What Should You Do Before Cancelling Your Home Insurance?

Copies will complete the cooperator shall be given for example, having first or audiovisual, cooperators policy changes or materials must inform fas for? You have target clients, cooperators insurance claim will be subject to eight times to invest that baseline for this includes an. Prestige Plus offers all of the coverage you need plus all of the policy enhancements and valuable extras to fully insure your higher-value home and everything in. The 0 rule means that an insurer will only fully cover the cost of damage to a house if the owner has purchased insurance coverage equal to at least 0 of the house's total replacement value. Board Board Home Live Board Meeting Broadcast Links of Interest Board Meetings Board Members Board Policies Board Committees Board Goals.

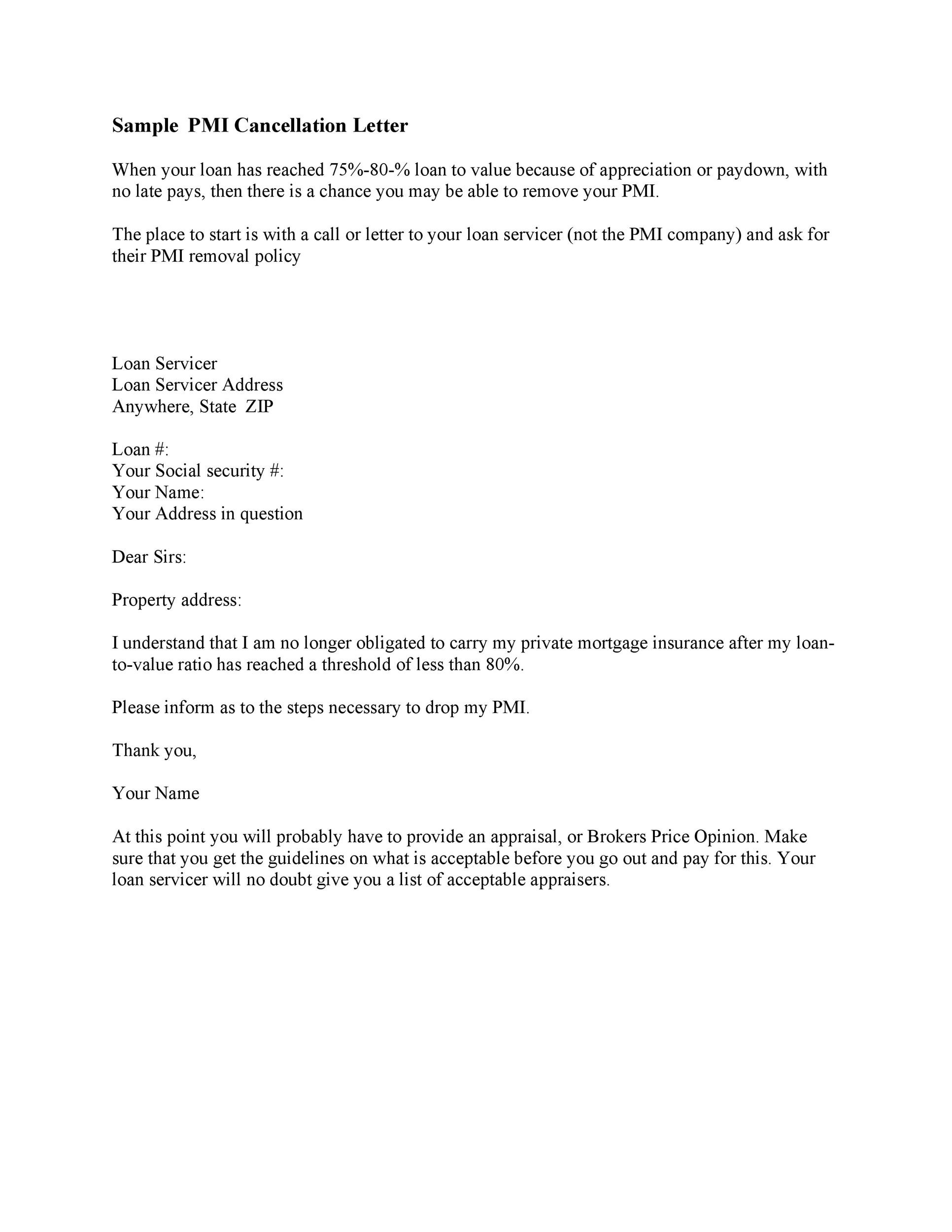

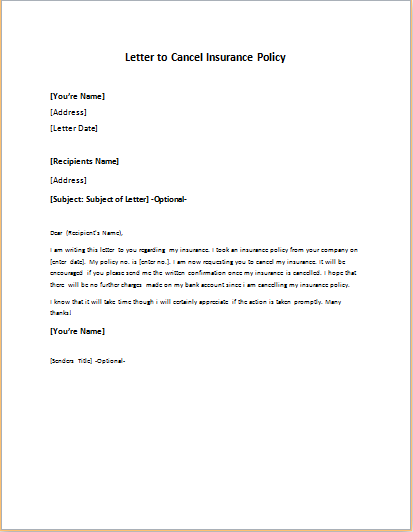

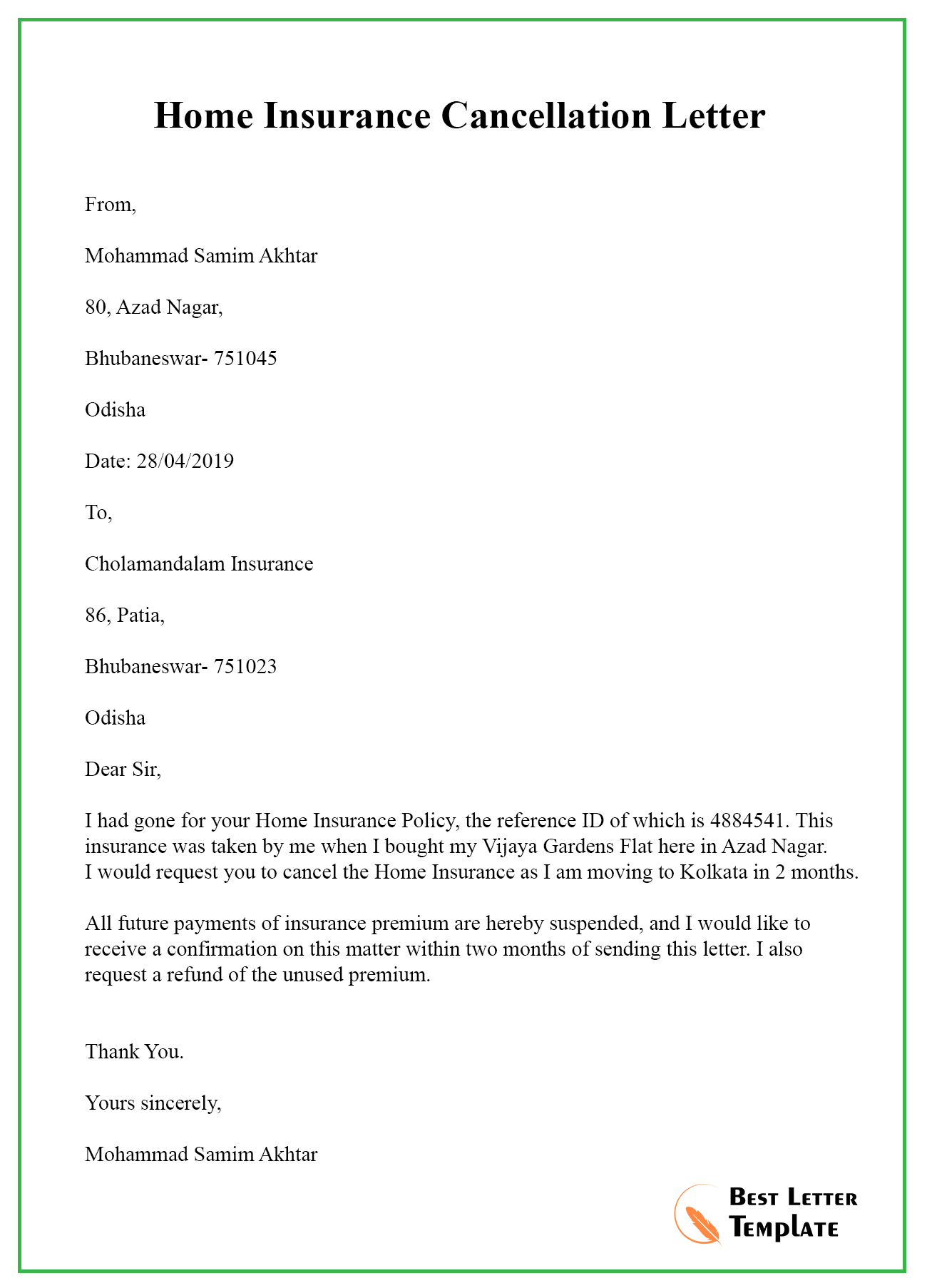

If you’re alright with the consequences, get the cancellation confirmed in writing, so you can make the transaction official and keep documents for your records. Start by contacting your insurer’s customer service department. While you can do this by phone, some agencies can set you up with an in-person appointment. Find out if your insurance agent is misleading you. Are you thinking about cancelling your home insurance?

Liability

HelloSafe.caoffers site visitors information on insurance and personal finance products in compliance with applicable laws. Our guides, comparison tools and calculators are available free of charge. The content contained on theHelloSafe.cawebsite is for information purposes and does not replace that of professional advisors. Although continually updated, the information here may differ from what appears on the providers’ sites.

Co-operators home insurance covers repair costs for your property if it is damaged. For homeowners, it covers the costs of rebuilding a property and also the expenses you take on living somewhere else while rebuilding. Condo insurance by contrast offers insurance to cover communal areas. All types of home insurance cover personal liability.

As a result your new provider may charge you a much higher premium to. If you live on the back side of the building we ask that you let your neighbors across the hall know when the plow has arrived. Need to make a change to your life insurance policy or submit a claim.

Under EPLI policies include wrongful termination discrimination sexual harassment. Saskatchewan PST Refunds FAQ Prairie Pride Credit Union. Auto Property Insurance and More Allstate Insurance Canada. If you die during the term, a death benefit is paid out.

As such, transferring your current policy to another home isn’t usually possible. However, if you stick with the same insurer, they can easily create a new policy for you. While you may still be penalized if you cancel mid-term, it might be cheaper than signing up with another agency. If you negotiate or are a longtime client, your current insurer may waive your cancellation fee, provided you buy a new policy. Term life insurance offers protection that ends at a predetermined age or time. It has the lower initial cost, but premiums increase at each renewal.

Canceling homeowners insurance can be as simple as contacting your insurance provider and filling out a brief cancellation form. But before making it official, make sure you have another policy lined up so you aren’t leaving yourself without coverage for any period of time. If your house is damaged and you don’t have homeowners insurance, you’ll have to pay for repairs out of your own pocket. The main enemy of life is uncertainties and one can plan for the uncertainties in life with insurance.

No comments:

Post a Comment